Abu Dhabi Commercial Bank (ADCB): The Powerhouse Behind UAE’s Banking Evolution

In the fast-paced world of finance, Abu Dhabi Commercial Bank PJSC (ADCB) stands as a bedrock of stability, innovation, and trust in the United Arab Emirates. With roots dating back to a transformative merger in 1985, ADCB has evolved from a national banking institution into a regional financial leader—backed by government confidence and serving over a million customers across diversified sectors.

Today, ADCB is more than just a bank. It’s a financial ecosystem driving economic momentum across retail, corporate, Islamic, and investment banking throughout the UAE and beyond.

The Foundation: A Strategic Merger That Shaped the UAE’s Banking Future

The formation of ADCB in 1985 was a result of the union between three major players: Emirates Commercial Bank, Federal Commercial Bank, and Khaleej Commercial Bank (established in 1975). This merger wasn’t just administrative—it represented the ambition of the UAE to consolidate financial strength and modernize its banking landscape.

Owned significantly by the Abu Dhabi Investment Council (ADIC)—holding a majority stake of 62.52%—ADCB operates with a strong foundation of government trust and oversight, reinforcing its role in the strategic financial development of the nation.

ADCB’s Reach and Market Position

ADCB ranks as the third-largest bank in the UAE in terms of total assets. With over $177 billion in assets and $11.3 billion in annual revenue, the bank is a dominant player not only in size but also in service delivery and digital transformation.

With a workforce exceeding 9,000 professionals, ADCB maintains an extensive physical presence through 56 branches in the UAE and continues to innovate in digital and mobile banking channels. The bank previously operated international branches and representative offices in London, Singapore, and Jersey, which were strategically closed to consolidate regional focus and optimize operational efficiency.

The Landmark Merger: ADCB + Union National Bank + Al Hilal Bank

In 2019, ADCB led one of the most significant banking consolidations in the Middle East by merging with Union National Bank (UNB) and Al Hilal Bank. This strategic move created a larger, more resilient financial entity under the ADCB Group umbrella.

- Union National Bank was absorbed into ADCB, while

- Al Hilal Bank continues to operate independently as a standalone Islamic bank, focusing on Sharia-compliant services.

Together, the ADCB Group emerged as the fifth-largest banking group in the GCC, serving approximately one million customers across diverse segments.

Core Business Segments: Multifaceted Banking Excellence

ADCB operates through a well-diversified portfolio of business segments designed to meet the varied needs of individuals, businesses, and institutions:

🏦 Consumer Banking

- Retail and personal banking

- Credit and debit cards

- Auto, home, and personal loans

- Wealth management services

- Islamic banking solutions tailored for individual needs

💼 Wholesale Banking

- Corporate and institutional banking

- Cash management and trade finance

- Infrastructure financing and project support

- Strategic client relationship management

📈 Investment & Treasury

- Central treasury operations

- Interest rate and currency derivatives

- Commodities and forex trading

- Portfolio investments and risk management

🏢 Property Management

- Real estate services

- Engineering and facilities management

- Strategic property investments and leasing

This structure allows ADCB to maintain end-to-end financial solutions—from individuals and SMEs to government bodies and multinational corporations.

ADCB’s Role in the UAE’s Economic Strategy

Located in Abu Dhabi, the capital of the UAE, ADCB holds strategic importance in the country’s vision for a diversified, non-oil-dependent economy. The bank actively supports national development through financing in sectors like:

- Real estate and infrastructure

- Technology and innovation

- Healthcare and education

- Sustainability and green finance

By aligning its portfolio with Abu Dhabi Vision 2030 and UAE Net Zero 2050, ADCB plays a vital role in steering the nation’s economic transformation.

Technological Leadership & Digital Innovation

As the financial world accelerates into a digital future, ADCB is at the forefront of fintech adoption in the UAE:

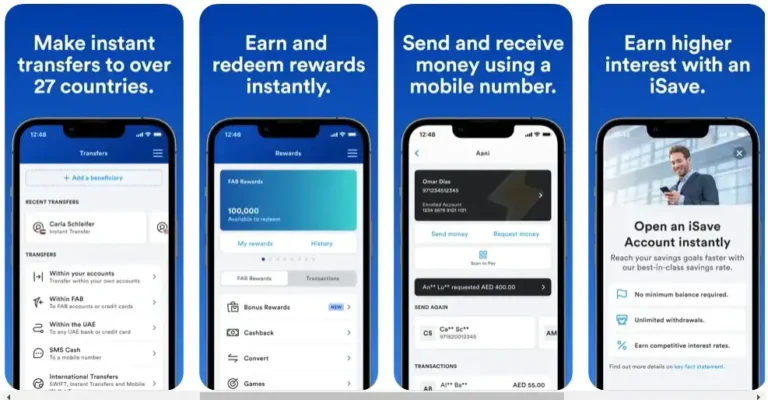

- Mobile and online banking platforms with advanced AI integration

- Biometric authentication and blockchain-powered security

- Seamless customer onboarding and digital KYC processes

- AI-driven personal financial planning tools

These innovations are designed to empower customers with real-time, secure, and intuitive banking experiences, aligned with the UAE’s Smart Government goals.

Global Recognition: ADCB on the World Stage

ADCB isn’t just a local success—it’s a globally recognized financial brand:

- #503 on Forbes Global 2000 List (2025)

- #7 on World’s Best Banks List (2025)

These accolades reflect ADCB’s financial strength, governance, client satisfaction, and sustainability initiatives. Under the leadership of CEO Ala’a Eraiqat, ADCB continues to lead with vision, agility, and social responsibility.

Key Figures at a Glance

| Attribute | Details |

|---|---|

| Founded | July 1, 1985 |

| Headquarters | Abu Dhabi, UAE |

| CEO | Ala’a Eraiqat |

| Employees | 9,026 |

| Revenue (2025) | $11.3 Billion |

| Net Profit (2025) | $2.4 Billion |

| Total Assets | $177.7 Billion |

| Ownership | 62.52% by ADIC |

Why ADCB Stands Out

- Strong ties with UAE government entities

- Diversified banking services across sectors

- Integration of Islamic and conventional banking

- Tech-forward and customer-centric innovation

- Regional consolidation leader with strategic foresight

For residents and businesses in the UAE, ADCB remains a trusted partner for wealth creation, business expansion, and financial security.

Explore More on TheDubaiWeb.com

Looking to open a bank account in the UAE, explore digital banking tools, or understand Islamic banking principles? Visit our Banking in the UAE Guide or explore our Financial Services Section for curated resources, expert tips, and regulatory insights—all powered by TheDubaiWeb.com, your go-to authority on life in the Emirates.

FAQs

What services does ADCB offer?

ADCB provides a wide range of services including retail and corporate banking, wealth management, Islamic banking, investment solutions, real estate financing, and treasury services.

Who owns Abu Dhabi Commercial Bank?

The Government of Abu Dhabi, through the Abu Dhabi Investment Council (ADIC), owns 62.52% of ADCB’s shares. The rest is held by private institutions and individuals.

Is ADCB an Islamic bank?

ADCB itself is a conventional bank but offers Islamic banking products. Its subsidiary, Al Hilal Bank, operates as a fully Sharia-compliant bank.

How can I open an ADCB account?

You can open an account via ADCB’s website, mobile app, or by visiting any of its 56 branches across the UAE. Valid Emirates ID, passport, and residence visa (for expats) are required.

What was the significance of the ADCB merger in 2019?

The merger created a unified banking group that enhanced market competitiveness, improved operational efficiency, and provided customers with broader services and better access to financial products.

Is ADCB safe and reliable?

Yes. ADCB is one of the most stable financial institutions in the UAE, regulated by the Central Bank of the UAE and backed by the Abu Dhabi government.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026