FAB Etihad Guest Account, UAE – Banking That Rewards Your Travel

Bank accounts are no longer just about storing money — they’ve become lifestyle companions. In the UAE, where travel and global connectivity define much of daily life, the FAB Etihad Guest Account stands out as one of the most rewarding banking options. Created in partnership between First Abu Dhabi Bank (FAB) — the UAE’s largest bank — and Etihad Guest, the loyalty program of Etihad Airways, this account blends everyday banking convenience with premium travel perks.

If you’re a frequent flyer, a business traveler, or even someone planning to maximize daily spending, this account ensures that every dirham you spend can take you closer to your next destination.

Why Choose the FAB Etihad Guest Account?

Unlike a standard current or savings account, the FAB Etihad Guest Account links your finances directly with Etihad Guest Miles, allowing you to convert banking activities into travel rewards. Here’s what makes it unique:

1. Seamless Digital Banking

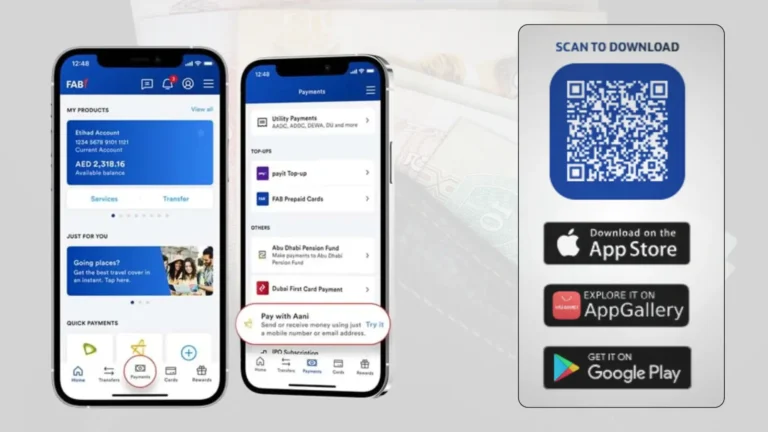

FAB’s award-winning mobile app allows you to open and operate your Etihad Guest Account instantly using just your Emirates ID. From checking balances to transferring funds, everything is a tap away.

2. Premium Debit Card Privileges

With this account, you receive a free Etihad Guest Platinum Debit Card. Daily limits are generous — AED 20,000 for ATM withdrawals and AED 40,000 for retail transactions — making it a powerful tool for both everyday purchases and travel spending.

3. Travel Protection & Global Insurance

Your debit card comes bundled with:

- Purchase Protection & Extended Warranty on eligible items.

- International Medical & Travel Assistance, offering peace of mind when abroad.

4. Earn Miles Every Day

Every transaction contributes toward your travel goals:

- 2 miles per AED 10 spent locally.

- 2.5 miles per AED 10 spent internationally.

- 4 miles per AED 10 on Etihad Airways and partner spends.

- 500 bonus miles on your first debit card purchase.

- 500 bonus miles when you transfer your first salary.

- Maintain an average balance of AED 10,000 monthly, and you’ll earn 1.5 miles per AED 1,000.

5. Cost-Friendly Banking

- Zero balance requirement — no penalties if you don’t maintain a minimum balance.

- Free chequebook and unlimited FAB ATM withdrawals.

- Two free non-FAB ATM withdrawals per month within the UAE.

- Free local fund transfers (up to four per month).

- One free international remittance each month.

Recommended: FAB One Account

Key Features & Benefits at a Glance

- Currency: Account available in AED only.

- Interest on Debit Balance: 19% annually (minimum AED 175 per month if overdrawn).

- Chequebook: First chequebook free (10 or 25 leaves, depending on relationship).

- Remittances: Free for the first monthly international transfer in AED.

- Banking Channels: Apply via FAB Mobile App, FAB website, branches, or phone banking.

Recommended: FAB Personal Current Account

Eligibility for FAB Etihad Guest Account

To qualify, applicants must:

- Be a UAE resident.

- Be at least 18 years old.

- Have a minimum monthly salary of AED 10,000, OR make an initial deposit of AED 10,000 if self-employed.

Required Documents

FAB generally requires:

- Completed application form.

- Emirates ID, passport, and residence visa copy.

- Proof of income (salary certificate or equivalent).

Note: FAB may request additional documents depending on your profile.

How to Open a FAB Etihad Guest Account

- FAB Mobile App: The fastest way — download from App Store, Google Play, or AppGallery, register with your Emirates ID, and open your account instantly.

- FAB Website: Fill in the online application form; a bank representative will follow up.

- Branch Visit: Walk into any FAB branch across Dubai, Abu Dhabi, or the wider UAE to apply in person.

- Phone Banking: Call FAB’s customer service hotline and request account opening.

Fees & Charges

- Account Opening: Free.

- Minimum Balance: Not required.

- Account Closure: AED 105.

- Liability Letters: AED 63 (for embassies, govt. departments, or financial institutions).

- Cheque Book Fees: First chequebook free; subsequent books AED 21–26.25.

- Non-FAB ATM Withdrawals: First two free per month, AED 2.10 thereafter.

- International ATM Withdrawals: AED 21.

- Inward Transfers (UAE): AED 1.05.

- Foreign Transfers: AED 25 + VAT (bank correspondent fees may apply).

How This Account Fits the UAE Lifestyle

The UAE is a hub where financial services and international travel intersect. Whether you’re flying from Abu Dhabi International Airport on Etihad Airways, managing business across Dubai’s financial districts, or sending money overseas, the FAB Etihad Guest Account brings together lifestyle, convenience, and loyalty rewards.

For professionals, expatriates, and families who frequently travel or send remittances, this account creates tangible value beyond standard banking.

FAQ – FAB Etihad Guest Account, UAE

1. Is there a fee to open the FAB Etihad Guest Account?

No. Opening the account is completely free.

2. Do I need to maintain a minimum balance?

No minimum balance is required. However, maintaining AED 10,000 monthly helps you earn extra Etihad Guest miles.

3. What debit card do I receive?

You’ll get a free Etihad Guest Platinum Debit Card, which comes with purchase protection, travel insurance, and high withdrawal limits.

4. How do I earn Etihad Guest Miles?

You earn miles when you:

- Spend with your debit card (domestic, international, and Etihad partner spends).

- Transfer your salary.

- Maintain a qualifying balance.

5. Is Etihad Guest membership free?

Yes. Joining Etihad Guest is free. You can sign up online or through FAB when opening your account.

6. Can I open this account if I’m self-employed?

Yes. You’ll need to make an initial deposit of AED 10,000 to qualify.

7. Does the account come with free remittances?

Yes. You get one free international remittance per month and several free local transfers.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026