First Abu Dhabi Bank, UAE: The Financial Powerhouse Shaping the Middle East and Beyond

First Abu Dhabi Bank (FAB) isn’t just the largest bank in the United Arab Emirates — it’s one of the most strategically important financial institutions in the MENA region, with a growing international footprint that spans five continents. Headquartered in Abu Dhabi at the iconic Khalifa Business Park, FAB is a cornerstone of the UAE’s banking sector and an embodiment of the country’s vision for global financial leadership.

A Fusion of Strength: The Merger That Made FAB

FAB was born from the historic 2017 merger between First Gulf Bank (FGB) and the National Bank of Abu Dhabi (NBAD) — two of the UAE’s financial giants. This merger was more than a strategic consolidation; it was a statement of intent. Through a share swap agreement, shareholders of FGB received 1.254 NBAD shares for each FGB share. The result? A banking behemoth with unmatched financial capacity, brand equity, and market reach.

The brand identity of FAB combines the legacy and ambition of its predecessors. The name “First Abu Dhabi Bank” merges the credibility of NBAD with the progressive dynamism of FGB. Its logo, featuring the enlarged “Awwal” mark, emphasizes FAB’s leadership ethos and aspiration to always be first.

Related: FAB Balance Check

Global Reach, Local Strength

FAB’s operations extend far beyond the borders of the UAE. With a presence in over 20 markets across Asia-Pacific, Europe, the Americas, and Africa, FAB is a key player in cross-border banking. It also began operations in Saudi Arabia in 2019, underscoring its regional influence.

FAB’s global stature is reinforced by its close ties with the Abu Dhabi government. This relationship provides strong backing and exceptional access to sovereign and semi-government clients. Notably, nearly 27% of FAB’s loans are directed to government and public sector counterparties — a figure that reflects its trusted role in national development.

Financial Resilience and Performance

FAB’s financials paint a picture of consistent growth, resilience, and prudent management. Despite the global volatility in 2020, the bank recorded a net profit of AED 10.6 billion. By 2021, under the leadership of Group CEO Hana Al Rostamani, profits surged by 19%, reaching US$3.4 billion.

In the first half of 2024, FAB posted an operating profit of 3.2% of risk-weighted assets, up from 2.9% in 2023. This growth was fueled by increased lending, strong non-interest income, and an elevated net interest margin. While provisioning increased in high-risk markets like Egypt, FAB’s robust capital adequacy ratio (CET1 at 14%) and ample liquidity (a 70% loans-to-deposit ratio) kept the bank comfortably ahead of its peers.

Related: Abu Dhabi Commercial Bank

Fitch Ratings and Market Confidence

Fitch Ratings affirmed FAB’s Long-Term Issuer Default Rating (IDR) at ‘AA-‘ with a stable outlook, highlighting its systemic importance and strong government support. Its Viability Rating of ‘a-‘ also reflects FAB’s flagship status, exceptional domestic franchise, and strong liquidity and funding profile.

This rating positions FAB among the highest-rated banks in emerging markets. The high share of government deposits (38%) and a strong base of current and savings accounts (46%) further underpin the bank’s funding strength.

Awards, Rankings, and Global Recognition

FAB consistently ranks as a leading financial institution in global and regional benchmarks:

- Global Finance: Safest Bank in the UAE and the Middle East

- The Banker: Top bank in the UAE and second in the Middle East by Tier 1 capital

- Forbes Global 2000 (2025): #240 globally and #1 in the UAE

These accolades are a testament to FAB’s role not just as a local bank, but as a global financial leader.

Leadership and Corporate Structure

Under the dynamic leadership of Hana Al Rostamani, FAB has accelerated its innovation and sustainability agendas. The bank is structured as a Public Joint Stock Company governed under UAE federal law and operates its UK branch since 1993.

FAB employs over 6,700 professionals, driving corporate and investment banking, personal finance, and Islamic banking solutions. It also maintains robust compliance with international financial reporting standards, transparency in governance, and publishing annual financials.

Related: Abu Dhabi Islamic Bank

FAB and the Digital Future

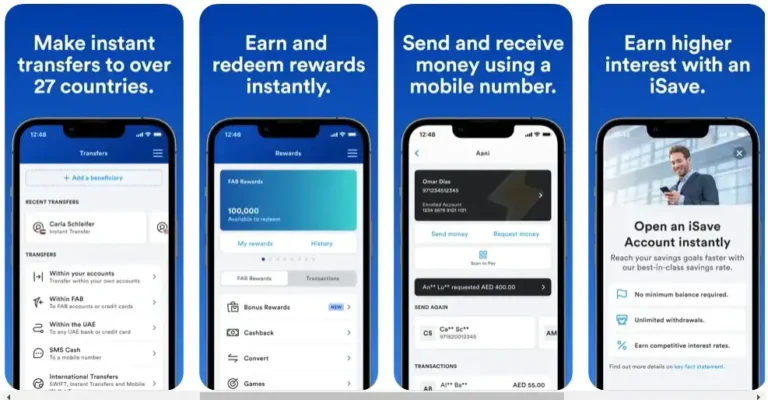

As fintech innovation reshapes the global banking sector, FAB is investing heavily in digital transformation. From AI-powered customer service to digital wealth management platforms, the bank is positioning itself at the forefront of smart banking in the UAE. The push toward sustainability is also evident in FAB’s ESG-focused initiatives and green financing solutions.

FAQs

Who owns First Abu Dhabi Bank?

First Abu Dhabi Bank is a publicly listed company, but it maintains strong ties with the Abu Dhabi government, which retains significant ownership through sovereign wealth entities.

What is the minimum salary to open a FAB account?

FAB typically requires a minimum monthly salary of AED 5,000 to open a salary transfer account, though requirements may vary by product.

Is FAB a legal and regulated bank?

Yes, FAB is a licensed and fully regulated financial institution under the UAE Central Bank and complies with international banking standards.

Is FAB the largest bank in the UAE?

Yes, by total assets, loans, and deposits, First Abu Dhabi Bank is the largest bank in the UAE and one of the largest in the MENA region.

Who is the CEO of FAB?

Hana Al Rostamani was appointed as the Group Chief Executive Officer in 2021, becoming the first female CEO of a major UAE bank.

How safe is First Abu Dhabi Bank?

FAB holds strong credit ratings (AA-/Stable from Fitch), high liquidity, and significant public-sector backing, making it one of the safest banks in the region.

Is FAB an Islamic bank?

While FAB is a conventional bank, it offers Shariah-compliant banking products and services under its dedicated Islamic Banking division.

What is FAB’s international presence like?

FAB has operations in 20+ countries including Saudi Arabia, Egypt, the UK, the US, and Singapore, reinforcing its global reach.

Which bank is best for salary accounts in the UAE?

FAB is often ranked among the top banks for salary accounts due to its low-fee structure, digital services, and customer support.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026