FAB PPC Card, UAE — Everything You Need to Know About First Abu Dhabi Bank’s Prepaid Solution

In the UAE’s fast-evolving financial landscape, convenience, digital security, and accessibility have become cornerstones of modern banking. Among the most practical innovations serving residents and workers alike is the FAB PPC Card, a Prepaid Payment Card issued by First Abu Dhabi Bank (FAB) — one of the UAE’s most trusted financial institutions.

Whether you’re an employee receiving your salary, a business managing payroll, or a resident seeking a safe cash alternative, the FAB PPC Card simplifies how you access, spend, and manage money across the Emirates.

What is the FAB PPC Card?

The FAB PPC Card (Prepaid Payment Card) is a reloadable prepaid card offered by First Abu Dhabi Bank, designed to make everyday financial transactions effortless. Unlike a debit or credit card, this card is not linked to a traditional bank account. Instead, it’s preloaded with funds — allowing you to spend only what’s available, which helps in maintaining better control over personal finances.

FAB’s prepaid solution is particularly popular among employers, government organizations, and payroll service providers, who use it to disburse salaries to unbanked or underbanked employees across the UAE.

Recommended: FAB Balance Check

Key Features and Benefits of the FAB PPC Card

1. Prepaid Convenience

The card functions on a prepaid system, which means users can only spend the amount loaded onto it. This makes it ideal for budget-conscious individuals and employees without traditional bank accounts.

2. Safe and Secure Transactions

Since the card is not directly connected to a bank account, it provides an extra layer of security. In case of loss or theft, your main banking details remain protected. The FAB PPC Card also uses secure chip technology, ensuring peace of mind during in-store and online transactions.

3. Easy Online and Offline Use

Cardholders can shop online, make in-store purchases, and withdraw cash at ATMs across the UAE and abroad (where supported). It’s a multi-purpose card designed for flexibility and accessibility.

4. Ideal for Payroll Distribution

One of the card’s most common uses is in payroll management. Employers can easily credit salaries to the PPC cards of their staff — especially helpful for workers without personal bank accounts. This system supports financial inclusion across the UAE, ensuring everyone has a safe and reliable way to receive their income.

5. Transparent Spending and Budgeting

Every transaction made through the FAB PPC Card is tracked online, giving users full visibility into their spending habits. This transparency helps in building responsible financial behavior and managing expenses effectively.

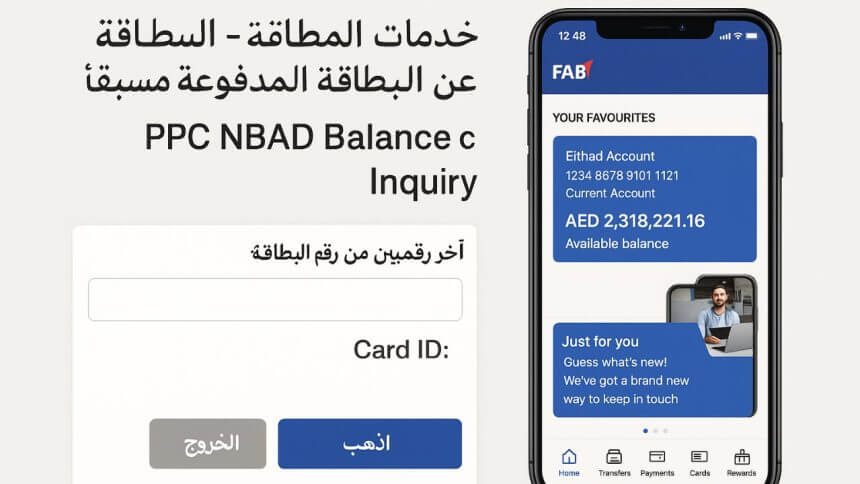

How to Check Your FAB PPC Card Balance

Monitoring your FAB PPC Card balance is simple and can be done in just a few steps:

- Visit the official FAB PPC Card portal.

- Enter your card number and the last two digits of your registered mobile number.

- Instantly view your balance, recent transactions, and salary credits.

If you’ve forgotten your registered mobile number or face login issues, you can contact FAB customer service or visit the nearest FAB branch for assistance.

💡 Pro Tip: Bookmark the official PPC portal or access it through FAB’s main website to avoid phishing sites and ensure data safety.

Why the FAB PPC Card Matters in the UAE

In a country with a large workforce and a growing digital economy, prepaid financial tools like the FAB PPC Card play a vital role in financial inclusion. The UAE government’s initiatives, such as Wages Protection System (WPS), align with FAB’s mission to ensure every worker receives secure and traceable salary payments.

Moreover, as Dubai and Abu Dhabi move toward cashless ecosystems, prepaid cards provide a bridge between traditional cash users and digital payment infrastructure — making it easier for residents to participate in e-commerce, bill payments, and modern financial services.

Managing Your FAB PPC Card Online

Beyond checking your balance, the FAB PPC portal allows you to:

- View transaction history for better expense tracking.

- Monitor salary deposits and payment dates.

- Update registered mobile details or report issues directly to FAB.

These features empower cardholders to stay in control without needing a traditional bank account or visiting a branch frequently — perfectly aligned with FAB’s digital-first vision.

Security and Fraud Protection

FAB takes customer protection seriously, implementing advanced encryption protocols, real-time fraud detection, and 24/7 monitoring systems. Users are encouraged to:

- Avoid sharing card details or OTPs.

- Use secure ATMs and verified websites for transactions.

- Report suspicious activity immediately via the FAB Customer Care Helpline.

This ensures every FAB PPC Cardholder enjoys not only convenience but also uncompromised security.

FAB PPC Card vs. Traditional Bank Account

| Feature | FAB PPC Card | Traditional Bank Account |

|---|---|---|

| Account Requirement | No | Yes |

| Payroll Use | Ideal for unbanked employees | Requires active bank account |

| Spending Limit | Limited to loaded funds | Based on account balance |

| Online Access | Via FAB PPC portal | Via full banking app/portal |

| Security | High (not linked to main account) | Dependent on main account safety |

How TheDubaiWeb.com Helps You Stay Informed

At TheDubaiWeb.com, we regularly publish trusted insights about UAE banking, digital payments, and financial solutions like the FAB PPC Card. Whether you want to learn about salary card services, Etisalat prepaid plans, or transport options like Hafilat cards, our guides are written to help UAE residents make informed, confident decisions.

FAQ – FAB PPC Card, UAE

1. What does PPC stand for in FAB PPC Card?

PPC stands for Prepaid Payment Card, a reloadable card that allows users to spend only the amount loaded onto it.

2. Can I use my FAB PPC Card for online shopping?

Yes, you can use the card for online purchases, bill payments, and subscriptions, as long as the website accepts UAE-based prepaid cards.

3. How can I reload my FAB PPC Card?

Reloading typically happens through your employer or organization that issued the card. Individuals cannot manually top-up unless authorized by FAB.

4. What should I do if I lose my FAB PPC Card?

Immediately contact FAB customer service or visit your nearest FAB branch to block the card and request a replacement.

5. Is the FAB PPC Card part of the UAE’s Wages Protection System (WPS)?

Yes. Many FAB PPC Cards are issued as part of WPS-compliant payroll systems, ensuring timely and traceable salary payments to workers.

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026

- FAB Salary Card Balance Check UAE – Online, SMS & ATM - January 6, 2026

- HSBC Bank Opening Hours in the UAE 2026 - January 3, 2026