FAB Savings Account, UAE

When it comes to growing your wealth in the UAE, few tools are as flexible and rewarding as a FAB Savings Account. First Abu Dhabi Bank (FAB) — the largest bank in the UAE and one of the most respected financial institutions in the Middle East — offers a range of savings options designed for different lifestyles, income levels, and financial goals. Whether you’re a young professional looking for simple digital banking, a frequent traveler seeking premium benefits, or a high-net-worth individual interested in elite privileges, FAB has a tailored solution.

In this guide, we’ll explore the types of FAB Savings Accounts, their features and benefits, eligibility criteria, required documents, and practical steps to open (or close) an account in the UAE.

Why Choose a FAB Savings Account in the UAE?

With the UAE’s dynamic economy and strong emphasis on financial innovation, residents and expatriates alike look for banking products that balance security, flexibility, and returns. FAB delivers on all three fronts.

Key reasons people open a FAB Savings Account include:

- Competitive interest rates across different balance tiers.

- Free debit cards with rewards, lifestyle perks, and travel benefits.

- Multi-currency support, ideal for expats managing money globally.

- High withdrawal limits and flexible remittance options.

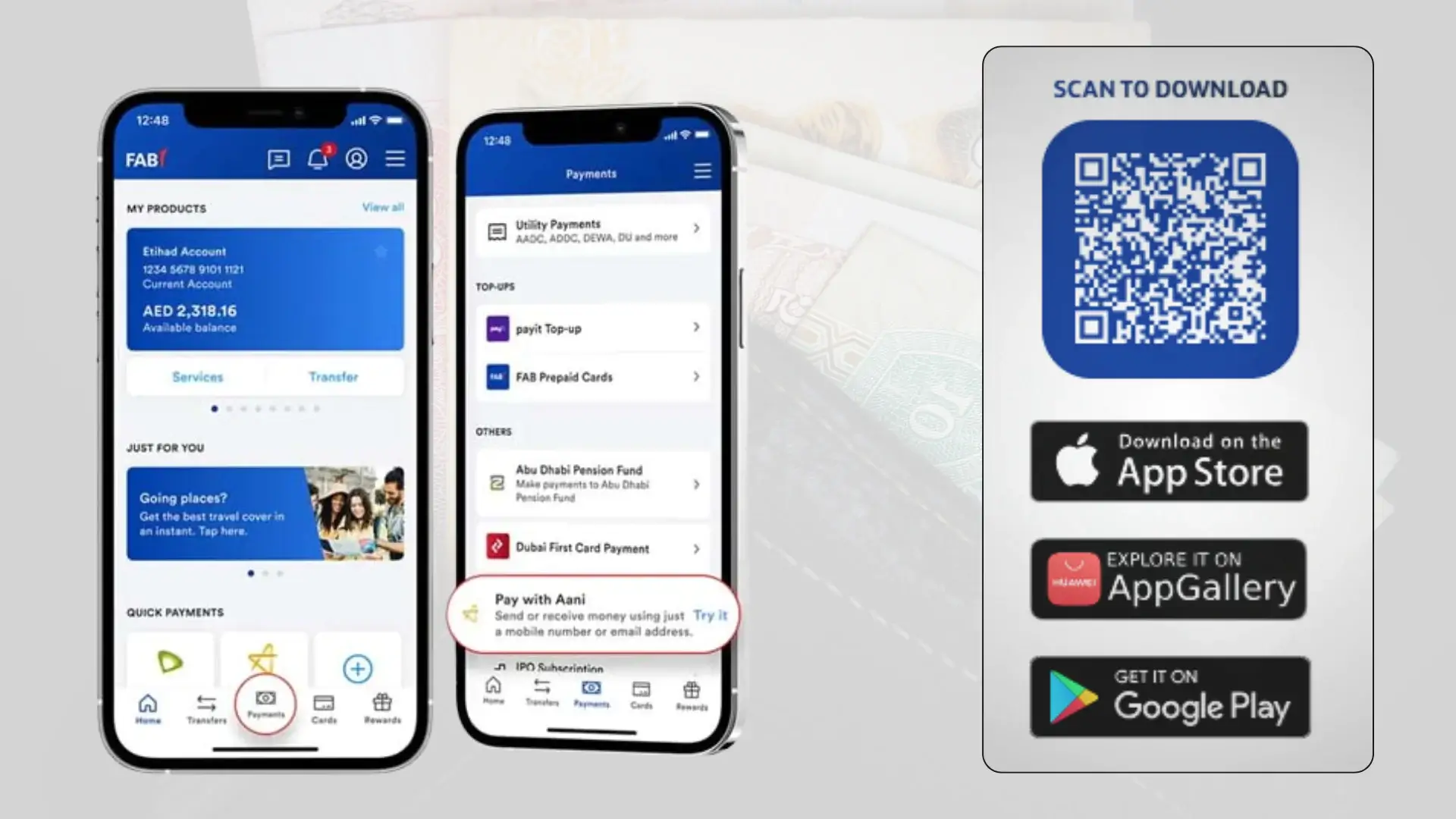

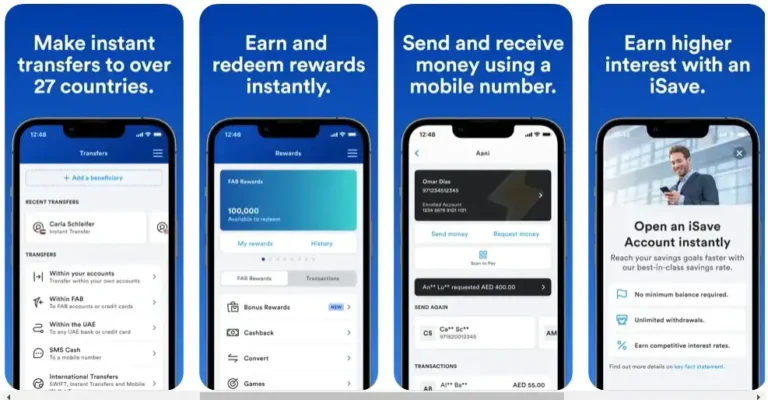

- Digital convenience with FAB Mobile and online banking.

Now let’s break down the different savings accounts FAB offers.

Types of FAB Savings Accounts

1. Elite Savings Account

For those seeking premium banking services, the FAB Elite Savings Account combines exclusivity with practical perks.

Features & Benefits:

- Multi-Currency Access: Available not only in AED but also in major global currencies.

- No Minimum Balance: No obligation to maintain a set balance.

- Free International Remittance: One free international transfer per month (AED accounts only).

- Interest Rates: Tiered and competitive returns.

- Elite Debit Card: Complimentary Elite MasterCard World Debit Card with:

- Free UAE ATM withdrawals.

- Daily ATM withdrawal up to AED 25,000.

- Purchase limit of AED 75,000.

- Four free international/GCC withdrawals monthly.

- Built-in purchase protection insurance up to USD 1,000 annually.

- Reward Points:

- 60 FAB Rewards per AED 100 spent locally.

- 120 FAB Rewards per AED 100 spent internationally.

- Redeemable for shopping, dining, travel, and bill payments.

2. Personal Savings Account

A versatile option for everyday savers who want to earn interest while enjoying essential banking privileges.

Features & Benefits:

- Multi-Currency Flexibility: Available in AED and major foreign currencies.

- Minimum Balance: AED 3,000 average monthly balance required (fee of AED 26.25 applies if not maintained).

- Debit Card Choices:

- Standard Debit Card (ATM limit AED 15,000/day; retail AED 20,000/day).

- Platinum Debit Card (ATM limit AED 20,000/day; retail AED 40,000/day).

- Travel Perks: Free access to select airport lounges across the Middle East with the Platinum card.

- Global Access: Cards usable worldwide for shopping, dining, and travel bookings.

3. Personal Call Account

Designed for individuals who value liquidity and currency flexibility.

Features & Benefits:

- Multi-Currency Transactions: Available in AED and global currencies.

- Interest Earnings: Competitive rates on maintained balances.

- Easy Transfers: Seamless movement of funds between FAB accounts.

- Minimum Balance: AED 3,000 required.

4. iSave Account

Perfect for digital-first customers, the iSave account makes saving seamless through FAB’s online and mobile platforms.

Features & Benefits:

- High Interest Rates: Up to 3.5% annually on new funds (promotional offers apply seasonally).

- No Minimum Balance: Easy access without penalties.

- AED Only: Transactions limited to UAE dirhams.

- Unlimited Withdrawals: No restrictions on access.

- Digital Opening: Quick setup via FAB Mobile App or online banking.

Interest Tiers:

- Less than AED 500,000 → up to 1.57%

- AED 500,000 – 5 million → 1.57% – 2.25%

- AED 5 million+ → 2.25%

Eligibility Criteria for FAB Savings Accounts

Opening a FAB Savings Account requires meeting specific eligibility standards, depending on the account type.

- Elite Savings Account: Total Relationship Balance (TRB) of AED 500,000 or more.

- Personal Savings Account: Minimum age 18; available to salaried, self-employed, residents, expats, and GCC nationals.

- Personal Call Account: Open to both residents and non-residents (salaried or non-salaried).

- iSave Account: UAE residents with access to FAB Mobile or Online Banking.

Required Documents

To comply with UAE banking regulations, FAB requires the following documents:

- Elite Savings Account: Completed form, salary certificate, valid passport, Emirates ID, resident visa.

- Personal Savings Account: Completed form, Emirates ID, passport, visa (salary certificate only if applying for credit).

- Personal Call Account: Completed application, proof of income, valid passport, Emirates ID or residence visa.

Note: FAB may request additional documents at its discretion.

How to Open a FAB Savings Account in the UAE

FAB makes account opening straightforward with multiple channels:

- FAB Mobile App: Open instantly with just a few taps.

- Online Banking: Secure, user-friendly portal for remote applications.

- Phone Banking: Request account opening through FAB’s customer service.

- Branch Visit: Traditional, in-person option for those who prefer face-to-face banking.

How to Close a FAB Savings Account

Closing is just as simple, though a closure fee of AED 105 applies.

Steps:

- Ensure your balance is zero (transfer funds to another account).

- Submit an account closure request via FAB branch or customer service.

- Pay the closure fee to finalize the process.

Frequently Asked Questions (FAQ)

1. What is the minimum balance for a FAB Savings Account?

It depends on the account type. The Personal Savings Account requires AED 3,000, while the Elite Savings and iSave Accounts have no minimum balance requirements.

2. Is a FAB Savings Account worth it?

Yes — FAB offers competitive interest rates, excellent digital banking tools, and global perks. It’s especially attractive for expats who need multi-currency support and international transfers.

3. Which bank gives 7% interest on savings accounts in the UAE?

Currently, no UAE bank offers a standard 7% savings interest. FAB’s iSave Account offers some of the highest rates in the UAE, up to 3.5% annually (depending on promotions and balance tiers).

4. Can non-residents open a FAB Savings Account?

Yes, certain FAB accounts like the Personal Call Account are open to both UAE residents and non-residents.

5. How do FAB Rewards Points work?

Rewards points accumulate with spending and can be redeemed for shopping, dining, travel bookings, or utility bill payments through FAB’s rewards portal.

Final Thoughts

A FAB Savings Account isn’t just a place to store your money — it’s a gateway to smarter financial management in the UAE. With accounts tailored for digital users, frequent travelers, and high-net-worth individuals, FAB ensures that every customer can save, earn, and spend more efficiently.

For more insights into banking, lifestyle, and financial planning in the UAE, explore our guides on FAB Current Accounts, salary accounts in Dubai, and business banking solutions here on TheDubaiWeb.com — your trusted resource for navigating life in the Emirates.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026