FAB Smart Deposit Account, UAE

When it comes to growing your savings in the UAE, First Abu Dhabi Bank (FAB) continues to stand out with its Smart Deposit Account — a flexible deposit solution offering competitive profit rates, multi-currency options, and tailored tenures. In a market where investors and savers are looking for both security and growth, the FAB Smart Deposit Account bridges convenience with reliable returns, making it a trusted choice among residents and non-residents alike.

Why the FAB Smart Deposit Account Matters in the UAE

The UAE is home to a diverse financial ecosystem, with global investors, expatriates, and locals seeking banking products that match international standards while accommodating local needs. FAB — the largest bank in the UAE and one of the strongest financial institutions in the region — designed its Smart Deposit Account to provide stability, predictable income, and a choice of payout structures.

Whether you are a salaried professional planning for medium-term goals or a non-resident safeguarding wealth in a stable economy, this account answers a core question: How can I grow my money with low risk while enjoying flexibility in returns?

Key Features of the FAB Smart Deposit Account

Unlike generic fixed deposits, FAB’s Smart Deposit Account is built with flexibility and multi-currency strength. Here’s what makes it stand out:

- Available Currencies: AED, USD, GBP, and EUR

- Tenure Options: 2, 3, 4, 5, 7, or 10 years

- Interest Payments: Monthly, every six months, or upon maturity — your choice

- Minimum Deposit Requirement: AED 30,000 or USD 10,000 (or equivalent in other supported currencies)

- Eligibility: Available for UAE residents, non-residents, salaried, non-salaried individuals, and even minors

These features make the Smart Deposit Account attractive for investors who want predictable growth without market volatility.

Eligibility Criteria

Opening a FAB Smart Deposit Account is relatively straightforward. You must:

- Be a UAE resident or non-resident

- Hold an existing FAB account for funding

- Be either salaried or non-salaried (self-employed applicants are excluded, with exceptions for minors)

This inclusivity allows expatriates, families, and even guardians managing funds for children to participate.

Documents Required

FAB follows strict compliance and KYC (Know Your Customer) standards, in line with UAE Central Bank regulations. To open a Smart Deposit Account, you’ll need:

- Emirates ID (for residents)

- Valid passport

- UAE residence visa (for expatriates)

- Duly filled fixed deposit application form

- Original documents plus copies

Additional documentation may be requested depending on your residency or employment status.

Interest Rates on the FAB Smart Deposit Account

One of the main reasons depositors choose FAB is its competitive interest rates across multiple currencies. The longer you commit your funds, the higher the potential returns.

AED Deposit Interest Rates

- 2 Years: Up to 3.61%

- 5 Years: Up to 4.22%

- 10 Years: Up to 5.47%

USD Deposit Interest Rates

- 2 Years: Up to 3.94%

- 5 Years: Up to 4.48%

- 10 Years: Up to 5.59%

GBP Deposit Interest Rates

- 2 Years: Up to 4.15%

- 5 Years: Up to 4.69%

- 10 Years: Up to 5.90%

EUR Deposit Interest Rates

- 2 Years: Up to 2.00%

- 5 Years: Up to 2.64%

- 10 Years: Up to 3.50%

💡 Pro Tip: GBP and USD deposits tend to offer the highest returns, making them attractive for international investors who want to hedge currency exposure.

Terms & Conditions You Should Know

Like any fixed deposit, FAB’s Smart Deposit Account comes with conditions that protect both the bank and the depositor:

- Minimum Deposit Duration: Interest is only paid if funds remain for at least 6 months.

- Premature Withdrawal: Early closure incurs a fee of AED 100 and reduced interest.

- Partial Withdrawals: Not allowed (entire deposit must be managed as a whole).

- Compliance Safeguards: FAB may reject transactions that conflict with UAE laws, international sanctions, or its banking policies.

- Customer Responsibility: You are accountable for ensuring your instructions to the bank are accurate and complete.

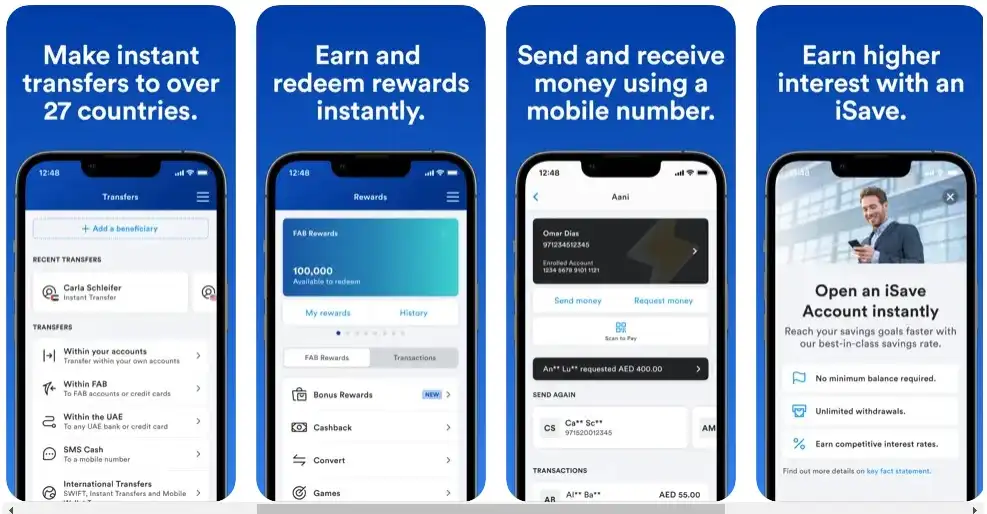

How to Open a FAB Smart Deposit Account

You can open a FAB Smart Deposit Account directly with the bank or via trusted platforms like Thedubaiweb.com, which helps compare UAE banking products.

Opening via Paisabazaar.ae

- Fill in details in the lead form.

- Review available bank account options.

- Select the FAB Smart Deposit Account.

- Submit your application.

A representative will then contact you to finalize the process.

👉 For a broader guide to UAE banking options, TheDubaiWeb.com also provides curated resources on savings accounts and financial planning in Dubai.

Benefits of the FAB Smart Deposit Account

- Competitive interest rates across multiple tenures

- Flexible interest payout frequency (monthly, semi-annual, or maturity)

- Multi-currency deposits (AED, USD, GBP, EUR)

- Security of one of the region’s most stable banks

- Eligible for residents, non-residents, and minors

This account is particularly appealing for long-term savers, expats securing funds in foreign currencies, and families planning for future needs.

Frequently Asked Questions (FAQ)

1. What is the minimum deposit required for the FAB Smart Deposit Account?

The minimum is AED 30,000 or USD 10,000 (or equivalent in GBP/EUR).

2. Can I open the account if I’m not a UAE resident?

Yes. FAB Smart Deposit Accounts are open to both UAE residents and non-residents.

3. What happens if I withdraw my money early?

A premature withdrawal incurs a fee of AED 100 and you may receive a reduced interest rate.

4. Are minors eligible for the FAB Smart Deposit Account?

Yes, minors can open an account through a guardian.

5. Is CAD (Canadian Dollar) available for deposits?

No. Currently, only AED, USD, GBP, and EUR are supported.

6. Does FAB require salary transfer for this account?

No. Salary transfer is not required to open a Smart Deposit Account.

7. How does this account compare to other fixed deposits in the UAE?

FAB’s Smart Deposit offers some of the most competitive long-term rates in the UAE, particularly in USD and GBP. Other banks may offer promotional rates, but FAB is valued for its stability and flexibility.

Final Thoughts

The FAB Smart Deposit Account is more than just a fixed deposit; it’s a tailored savings vehicle for a diverse range of investors. With multi-currency flexibility, customizable interest payouts, and the trust of UAE’s largest bank, it stands as a premier choice for anyone seeking stable and predictable returns.

For more insights into UAE banking, lifestyle, and financial planning, explore expert guides on TheDubaiWeb.com, your trusted authority for navigating Dubai’s evolving financial and cultural landscape.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026