PayPlus Card Balance Check Online, UAE

Keeping track of your money should never feel like a guessing game. In today’s digital-first world, UAE residents rely on quick and secure financial tools to manage their daily spending — and the Al Ansari Exchange PayPlus Card is one of the most widely used solutions. Whether you receive your salary through it or use it for everyday transactions, knowing how to check your PayPlus card balance online is essential for stress-free financial management.

This guide takes you step by step through every available method — from the Al Ansari Exchange website and mobile app to ATMs and customer service — while also sharing insider tips on security, common issues, and why regular balance checks can save you from unexpected headaches.

What is the Al Ansari PayPlus Card?

The PayPlus Card is a prepaid payroll and spending card issued by Al Ansari Exchange, one of the UAE’s leading currency exchange and remittance providers. Backed by Visa and integrated into the UAE Wages Protection System (WPS), it allows employees to securely receive salaries, withdraw cash, and make purchases — all without needing a traditional bank account.

Key Benefits of the PayPlus Card:

- 🌍 Worldwide Acceptance: Use it at any outlet, ATM, or online merchant that accepts Visa.

- 💳 Reloadable & Flexible: Easily top up your card when needed.

- 🛒 Everyday Convenience: Pay for groceries, flights, bills, or online shopping.

- 🔒 Security First: Protected by PIN codes, online transaction security, and optional two-factor authentication (2FA).

- 🏦 Free ATM Withdrawals: At Al Ansari Exchange branches across the UAE.

For both UAE nationals and expatriates, the PayPlus Card offers the reliability of a debit card without the restrictions of a bank account.

Why Should You Regularly Check Your PayPlus Card Balance?

Keeping a close eye on your PayPlus balance is more than just financial housekeeping — it’s about control and protection.

- Prevent Declined Payments → Avoid awkward moments at the checkout when your card runs low.

- Budget Smarter → Track your spending habits and adjust your budget accordingly.

- Early Fraud Detection → Spot unauthorized transactions before they snowball.

- Plan Ahead → Know when to reload your card before important expenses.

- Salary Confirmation → Instantly confirm whether your wages have been credited.

How to Check PayPlus Card Balance Online

Al Ansari Exchange makes it simple to check your card balance anytime, anywhere. Here are the main methods:

1. Via the Al Ansari Exchange Website

The website is ideal for desktop or laptop users.

- Visit www.alansariexchange.com

- Click on “Send Money Online” → choose Individual Login.

- Sign in using your credentials or UAE PASS.

- Navigate to the Card Section.

- Select your PayPlus Card → click Balance Check.

- Your balance will be displayed instantly.

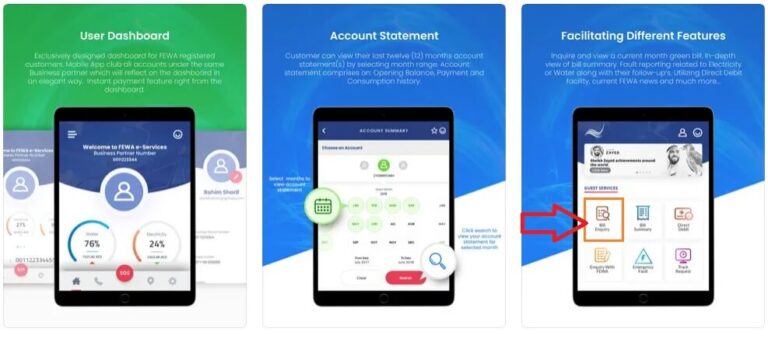

2. Through the Al Ansari Exchange Mobile App

Perfect for those on the go, the mobile app provides real-time balance tracking and transaction history.

- Download the Al Ansari Exchange App from:

- Google Play Store

- Apple App Store

- Register/Login with your credentials, UAE PASS, or mobile number.

- From the dashboard, go to Prepaid Cards → Card Balance.

- Tap Show to view your current balance.

3. Using an ATM (Visa Network)

If you prefer an offline option:

- Insert your PayPlus card into any Keeping track of your money should never feel like a guessing game. In today’s digital-first world, UAE residents rely on quick and secure financial tools to manage their daily spending — and the Al Ansari Exchange PayPlus Card is one of the most widely used solutions. Whether you receive your salary through it or use it for everyday transactions, knowing how to check your PayPlus card balance online is essential for stress-free financial management.

This guide takes you step by step through every available method — from the Al Ansari Exchange website and mobile app to ATMs and customer service — while also sharing insider tips on security, common issues, and why regular balance checks can save you from unexpected headaches.

What is the Al Ansari PayPlus Card?

The PayPlus Card is a prepaid payroll and spending card issued by Al Ansari Exchange, one of the UAE’s leading currency exchange and remittance providers. Backed by Visa and integrated into the UAE Wages Protection System (WPS), it allows employees to securely receive salaries, withdraw cash, and make purchases — all without needing a traditional bank account.

Key Benefits of the PayPlus Card:

🌍 Worldwide Acceptance: Use it at any outlet, ATM, or online merchant that accepts Visa.

💳 Reloadable & Flexible: Easily top up your card when needed.

🛒 Everyday Convenience: Pay for groceries, flights, bills, or online shopping.

🔒 Security First: Protected by PIN codes, online transaction security, and optional two-factor authentication (2FA).

🏦 Free ATM Withdrawals: At Al Ansari Exchange branches across the UAE.

For both UAE nationals and expatriates, the PayPlus Card offers the reliability of a debit card without the restrictions of a bank account.

Why Should You Regularly Check Your PayPlus Card Balance?

Keeping a close eye on your PayPlus balance is more than just financial housekeeping — it’s about control and protection.

Prevent Declined Payments → Avoid awkward moments at the checkout when your card runs low.

Budget Smarter → Track your spending habits and adjust your budget accordingly.

Early Fraud Detection → Spot unauthorized transactions before they snowball.

Plan Ahead → Know when to reload your card before important expenses.

Salary Confirmation → Instantly confirm whether your wages have been credited.

How to Check PayPlus Card Balance Online

Al Ansari Exchange makes it simple to check your card balance anytime, anywhere. Here are the main methods:

1. Via the Al Ansari Exchange Website

The website is ideal for desktop or laptop users.

Visit www.alansariexchange.com

Click on “Send Money Online” → choose Individual Login.

Sign in using your credentials or UAE PASS.

Navigate to the Card Section.

Select your PayPlus Card → click Balance Check.

Your balance will be displayed instantly.

2. Through the Al Ansari Exchange Mobile App

Perfect for those on the go, the mobile app provides real-time balance tracking and transaction history.

Download the Al Ansari Exchange App from:

Google Play Store

Apple App Store

Register/Login with your credentials, UAE PASS, or mobile number.

From the dashboard, go to Prepaid Cards → Card Balance.

Tap Show to view your current balance.

3. Using an ATM (Visa Network)

If you prefer an offline option:

Insert your PayPlus card into any First Abu Dhabi Bank (FAB) ATM or Visa-enabled machine.

Enter your PIN.

Select Balance Inquiry to view your balance on-screen or print a receipt.

✅ First two inquiries per month are free.

⚠️ AED 2 fee applies for additional checks.

4. Customer Service Hotline

For those without digital access:

Dial 600 54 6000 (available 8 AM – 12 AM daily).

Provide your card details and verify your identity.

The agent will confirm your current balance.

5. In-Branch Kiosks

Visit any Al Ansari Exchange branch across the UAE. Self-service kiosks and staff assistance are available for balance inquiries, card reloads, and transaction support.

Security Tips for Checking PayPlus Balance Online

Managing your balance online is convenient — but only when done securely:

🔑 Use Strong Passwords: Avoid predictable combinations like birthdays.

🛡 Enable 2FA: Adds a second verification layer to your account.

📧 Beware of Phishing Emails: Always log in via the official website or app, never through suspicious links.

📱 Keep Your App Updated: Ensure the latest security patches are active.

Common Issues & Troubleshooting

Login Failure → Reset your password via the “Forgot Password” option or try UAE PASS login.

Balance Not Updating → Refresh the app/website, log out, and try again.

ATM Errors → Use an Al Ansari branch ATM for guaranteed support.

Advantages of Checking Balance Online vs ATM

Instant Access (no branch visits required).

Real-Time Updates on every transaction.

Global Accessibility (check balance even while abroad).

Fewer Fees compared to repeated ATM inquiries.

Conclusion

The Al Ansari PayPlus Card has redefined how thousands of employees in the UAE receive and manage their wages. By offering an alternative to traditional banking, it empowers workers with flexibility, security, and global access to their funds.

Whether you prefer the website, mobile app, ATM, or a quick customer service call, keeping track of your PayPlus card balance online ensures that you’re always in control of your money.

💡 Pro Tip: Make it a habit to check your balance right after salary credit — it’s the simplest way to stay financially stress-free.

Frequently Asked Questions (FAQs)

1. How can I check my PayPlus card balance online?

You can log into the Al Ansari Exchange website or mobile app, or use an ATM for offline checks.

2. Is there a fee for online balance inquiries?

No, online balance checks via the app or website are completely free.

3. Can I check my PayPlus balance abroad?

Yes, as long as you have internet access, you can check your balance anywhere in the world.

4. What if I forget my PayPlus login or PIN?

Use the password reset option online or contact Al Ansari customer service to reset your PIN.

5. How often should I check my balance?

Ideally, at least once a week — and always after receiving your salary or before major purchases.

6. Can I view my transaction history online?

Yes, the mobile app and website both show your full transaction history.

7. Are ATM balance checks free?

The first two checks per month are free at FAB ATMs; after that, a fee of AED 2 applies.

8. How do I reload my PayPlus card?

You can reload through the Al Ansari app, website, or at any Al Ansari Exchange branch.

9. Is the PayPlus card safe for online shopping?

Yes — with PIN protection, Visa security features, and optional 2FA, it’s secure for online and in-store purchases.

10. What makes the PayPlus card different from a regular bank debit card?

Unlike bank cards, the PayPlus is prepaid — meaning no overdrafts, no minimum balance requirements, and easier access for non-bank account holders.or Visa-enabled machine. - Enter your PIN.

- Select Balance Inquiry to view your balance on-screen or print a receipt.

- ✅ First two inquiries per month are free.

- ⚠️ AED 2 fee applies for additional checks.

4. Customer Service Hotline

For those without digital access:

- Dial 600 54 6000 (available 8 AM – 12 AM daily).

- Provide your card details and verify your identity.

- The agent will confirm your current balance.

5. In-Branch Kiosks

Visit any Al Ansari Exchange branch across the UAE. Self-service kiosks and staff assistance are available for balance inquiries, card reloads, and transaction support.

Security Tips for Checking PayPlus Balance Online

Managing your balance online is convenient — but only when done securely:

- 🔑 Use Strong Passwords: Avoid predictable combinations like birthdays.

- 🛡 Enable 2FA: Adds a second verification layer to your account.

- 📧 Beware of Phishing Emails: Always log in via the official website or app, never through suspicious links.

- 📱 Keep Your App Updated: Ensure the latest security patches are active.

Common Issues & Troubleshooting

- Login Failure → Reset your password via the “Forgot Password” option or try UAE PASS login.

- Balance Not Updating → Refresh the app/website, log out, and try again.

- ATM Errors → Use an Al Ansari branch ATM for guaranteed support.

Advantages of Checking Balance Online vs ATM

- Instant Access (no branch visits required).

- Real-Time Updates on every transaction.

- Global Accessibility (check balance even while abroad).

- Fewer Fees compared to repeated ATM inquiries.

Conclusion

The Al Ansari PayPlus Card has redefined how thousands of employees in the UAE receive and manage their wages. By offering an alternative to traditional banking, it empowers workers with flexibility, security, and global access to their funds.

Whether you prefer the website, mobile app, ATM, or a quick customer service call, keeping track of your PayPlus card balance online ensures that you’re always in control of your money.

💡 Pro Tip: Make it a habit to check your balance right after salary credit — it’s the simplest way to stay financially stress-free.

Frequently Asked Questions (FAQs)

1. How can I check my PayPlus card balance online?

You can log into the Al Ansari Exchange website or mobile app, or use an ATM for offline checks.

2. Is there a fee for online balance inquiries?

No, online balance checks via the app or website are completely free.

3. Can I check my PayPlus balance abroad?

Yes, as long as you have internet access, you can check your balance anywhere in the world.

4. What if I forget my PayPlus login or PIN?

Use the password reset option online or contact Al Ansari customer service to reset your PIN.

5. How often should I check my balance?

Ideally, at least once a week — and always after receiving your salary or before major purchases.

6. Can I view my transaction history online?

Yes, the mobile app and website both show your full transaction history.

7. Are ATM balance checks free?

The first two checks per month are free at FAB ATMs; after that, a fee of AED 2 applies.

8. How do I reload my PayPlus card?

You can reload through the Al Ansari app, website, or at any Al Ansari Exchange branch.

9. Is the PayPlus card safe for online shopping?

Yes — with PIN protection, Visa security features, and optional 2FA, it’s secure for online and in-store purchases.

10. What makes the PayPlus card different from a regular bank debit card?

Unlike bank cards, the PayPlus is prepaid — meaning no overdrafts, no minimum balance requirements, and easier access for non-bank account holders.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026