FAB Bank Account, UAE: Complete Guide to Features, Types, and Eligibility

First Abu Dhabi Bank (FAB) is not just the UAE’s largest bank — it’s also one of the most powerful financial institutions in the Middle East. Formed from the historic merger of National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB), FAB has become a trusted name for millions of customers seeking innovative banking solutions. Whether you are a salaried professional, a business owner, or someone looking for Shariah-compliant options, opening a FAB bank account gives you access to world-class financial products and digital-first convenience.

In this guide, we’ll explore everything you need to know about FAB bank accounts — from their types and features to eligibility, required documents, and FAQs.

Why Choose a FAB Bank Account in the UAE?

FAB has built its reputation around security, innovation, and customer-centric banking. With a strong presence across the Emirates and partnerships that stretch globally, FAB accounts are designed to cater to different lifestyles and financial needs.

Key advantages of holding a FAB bank account include:

- Zero Balance Accounts: Many FAB accounts do not require you to maintain a minimum balance.

- Reward Programs: Earn FAB Rewards or Etihad Guest Miles with eligible accounts.

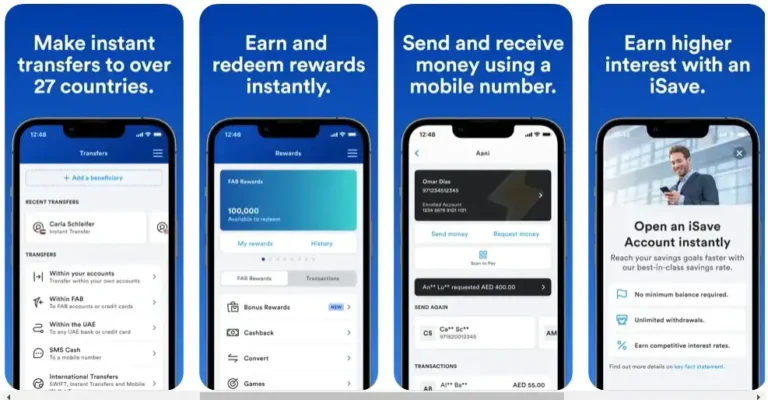

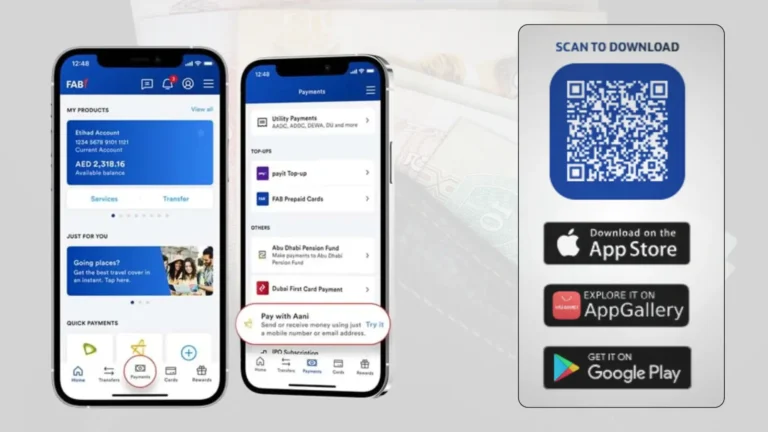

- Seamless Digital Banking: Manage accounts via FAB Mobile and Online Banking.

- Global Access: Withdraw cash in AED and other major currencies with ease.

- Travel & Lifestyle Benefits: Access airport lounges, complimentary chequebooks, and international remittance perks.

- Shariah-Compliant Options: Islamic current and savings accounts designed in accordance with Islamic finance principles.

Recommended: FAB Balance Check

Types of FAB Bank Accounts in the UAE

FAB offers a wide variety of accounts, each tailored to specific needs — from everyday banking to premium wealth management.

1. Current Accounts

A FAB Current Account is ideal for customers who need frequent transactions, cheque facilities, and salary transfers.

Popular FAB current accounts include:

- Personal Current Account – Standard day-to-day banking.

- FAB One Account – Zero balance with attractive benefits.

- Etihad Guest Account – Earn airline miles with every transaction.

- Elite Current Account – Premium benefits for high-income earners.

- Etihad Guest Elite Account – High-tier rewards with travel privileges.

2. Savings Accounts

FAB savings accounts are designed to encourage personal savings while offering attractive benefits.

Top FAB savings accounts include:

- FAB iSave Account – 100% digital account with instant opening.

- FAB Elite Savings Account – Exclusive rewards for premium customers.

- Personal Call Account – Flexible savings with easy withdrawals.

- Personal Savings Account – Conventional option with competitive returns.

3. Fixed Deposit Accounts

For individuals seeking guaranteed returns and capital protection, FAB offers fixed deposit and smart deposit accounts:

- FAB Smart Deposit Account – Flexible tenures with higher returns.

- FAB Fixed Deposit – Traditional deposit with fixed interest.

4. Islamic Bank Accounts

FAB also provides Shariah-compliant banking solutions, making it one of the leading Islamic finance providers in the UAE.

Options include:

- Islamic Current Account – Everyday banking with Islamic debit card.

- Islamic Savings Account – Profit-sharing savings model.

- Islamic Investment Deposit Accounts – Choose between Wakalah and Mudarabah contracts.

Recommended:

Documents Required to Open a FAB Bank Account

Opening a FAB account in the UAE is straightforward, but you’ll need to provide the right documentation.

For Conventional Accounts

- Original and valid Emirates ID, Passport, and Resident Visa

- Completed account opening form

- Valid proof of income (salary certificate, pay slips, or business income proof)

For Islamic Accounts

- Emirates ID and Passport with valid residence visa

- Recent salary certificate (issued within 30 days) or income proof for self-employed/non-salaried applicants

- Duly signed account opening application form

Eligibility Criteria for FAB Bank Accounts

The requirements differ depending on whether you choose a conventional or Islamic account.

Conventional Accounts

- Must be a UAE resident.

- Open to salaried, self-employed, or non-salaried individuals.

- Minimum monthly salary: AED 10,000.

- For non-salaried applicants: initial deposit of at least AED 10,000.

- Elite accounts require a Total Relationship Balance of AED 500,000, a salary transfer of AED 50,000, or a mortgage of AED 2.5 million.

Islamic Accounts

- Minimum age: 21 years old.

- Available to UAE nationals, GCC citizens, and resident expatriates.

- Salaried and self-employed individuals are eligible.

- Minimum deposits: AED 10,000 for Mudarabah and AED 500,000 for Wakalah accounts.

How to Open a FAB Bank Account Online

FAB has streamlined the process so you can open an account completely online.

- Visit the official FAB website or download the FAB Mobile App.

- Select the type of account you want to open.

- Complete the digital form and upload your documents.

- Verify your identity via Emirates ID scanning.

- Receive instant account activation in most cases.

👉 For more UAE banking insights and financial guides, explore TheDubaiWeb.com.

FAB Bank Account – FAQs

1. What is the minimum balance in FAB accounts?

Many FAB accounts allow zero balance. However, some accounts require a minimum average balance of AED 3,000.

2. What is the minimum salary required to open a FAB bank account?

For conventional accounts, the minimum salary is AED 10,000. Premium and elite accounts require higher income or deposits.

3. Can non-salaried individuals open a FAB bank account?

Yes, but they may need to make a minimum deposit of AED 10,000 for conventional accounts.

4. Can expatriates open a FAB bank account in the UAE?

Yes, FAB accounts are available for UAE residents, expatriates, and GCC nationals.

5. Is FAB a good bank in the UAE?

FAB is consistently ranked among the most trusted banks in the Middle East. With digital innovation, global presence, and strong customer service, it is an excellent choice for both personal and business banking.

6. Are FAB Islamic accounts fully Shariah-compliant?

Yes. FAB Islamic accounts follow strict Shariah principles, offering investment deposits through Wakalah and Mudarabah models.

Final Thoughts

Opening a FAB bank account in the UAE gives you access to one of the region’s most reliable financial ecosystems. Whether you’re looking for a zero-balance account, a savings plan, or a Shariah-compliant investment deposit, FAB provides versatile solutions for every stage of life.

For more trusted guides on UAE finance, lifestyle, and banking, visit TheDubaiWeb.com — your go-to platform for making smarter choices in Dubai and beyond.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026