FAB Etihad Guest Elite Account, UAE

Opening a bank account in the UAE isn’t just about managing your money — it’s about unlocking access to experiences, rewards, and lifestyle privileges that align with your ambitions. The FAB Etihad Guest Elite Account, offered by First Abu Dhabi Bank (FAB) in partnership with Etihad Airways, is one such product that blends day-to-day banking with global travel perks.

For frequent travelers, professionals relocating to the UAE, or residents who value premium financial services tied to loyalty programs, this account goes beyond the basics of banking. Let’s dive deep into its features, benefits, requirements, and everything you should know before applying.

Why Choose the FAB Etihad Guest Elite Account?

The FAB Etihad Guest Elite Account stands out because it doesn’t just serve as a personal current account—it connects you to the Etihad Guest Miles Loyalty Programme, offering tangible travel rewards every time you use your debit card or maintain account balances. This makes it particularly attractive for those who fly with Etihad Airways or its global partner network.

Here’s why many expats and UAE residents consider it a top-tier choice:

1. Earn Etihad Guest Miles with Everyday Banking

- Salary Transfer Bonus: Get 1,000 bonus miles when you transfer your first salary into the account.

- Balance Rewards: Maintain an average monthly balance of AED 10,000 or more and earn up to 5,000 miles each month.

- Debit Card Rewards:

- 750 joining miles on your first purchase.

- 3 miles for every AED 10 spent internationally.

- 2.5 miles for every AED 10 spent within the UAE.

- 5 miles for every AED 10 spent with Etihad Airways or Etihad Guest partners.

This means your daily spending turns into flight tickets, upgrades, and exclusive travel experiences.

2. Travel Privileges That Match a Jet-Setter Lifestyle

- Complimentary access to 650+ airport lounges worldwide.

- 24/7 concierge service for travel planning, reservations, and emergencies.

- Travel accident insurance up to USD 500,000 when booking flights with your Etihad Guest Signature debit card.

- Global medical and travel assistance, ensuring peace of mind wherever you fly.

3. Protection & Peace of Mind

FAB pairs its elite account with strong protection benefits:

- Extended warranty and purchase protection on items bought with your debit card.

- Support against fraud and unauthorized transactions.

- Free medical and emergency assistance abroad.

4. Seamless Digital Banking Experience

Through the FAB Mobile App and Internet Banking, customers enjoy:

- Real-time balance tracking.

- Instant fund transfers and bill payments.

- Quick account opening with Emirates ID, no paperwork required.

Recommended: FAB Elite Current Account

Key Features of the FAB Etihad Guest Elite Account

Unlike standard current accounts in the UAE, the Etihad Guest Elite Account brings a mix of flexibility and exclusivity.

- Zero Balance Requirement: No penalties for not maintaining a balance, though AED 10,000 is required to earn miles.

- Free Chequebooks and an Etihad Signature Debit Card.

- Cash Withdrawals: Free at FAB ATMs, 4 free withdrawals from non-FAB ATMs in the UAE, and 1 free withdrawal abroad every month.

- Fund Transfers: 4 free domestic transfers per month, plus one free international remittance.

- High Daily Limits: AED 75,000 for retail purchases and AED 30,000 for ATM withdrawals.

- Complimentary Services: Free account statements (within cycle) and digital access anytime.

Recommended: FAB Etihad Guest Account

Eligibility Criteria

To open a FAB Etihad Guest Elite Account, applicants must maintain a total relationship balance of AED 500,000 or more. This includes balances across savings, current, and call accounts, as well as fixed deposits and investments with FAB.

Documents Required

- Completed account opening form.

- Valid passport, UAE residence visa, and Emirates ID (original and copy).

- Proof of income (salary certificate, payslips, or employment contract).

Note: FAB may request additional documents depending on your profile.

Recommended: FAB One Account

Fees & Charges Overview

While many services are complimentary, some charges apply. Here are highlights:

- Account closure fee: AED 105

- Telegraphic transfers: 4 free AED transfers per month; AED 5.25 thereafter.

- Foreign transfers: AED 105 (USD/EUR/AUD) or AED 84 (other currencies).

- Cheque services: Free chequebooks; AED 100 for returned cheques.

- Debit card replacement: AED 26.25

Full details can be confirmed on FAB’s official schedule of charges.

Recommended: FAB Personal Current Account

How to Open a FAB Etihad Guest Elite Account

FAB offers flexible ways to apply:

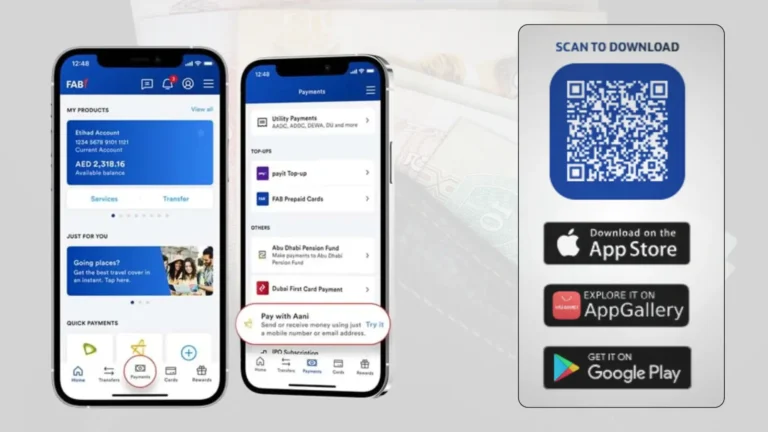

1. FAB Mobile App

- Download from Google Play, Apple App Store, or App Gallery.

- Use your Emirates ID for instant verification.

- Enjoy paperless account opening in just minutes.

2. Online Application

- Fill out the lead form on FAB’s official website.

- A bank representative will follow up for verification and completion.

3. Branch Visit

- Submit documents directly at a FAB branch.

- Ideal for those who prefer in-person interaction.

4. Phone Banking

- Call FAB’s official helpline to initiate your application.

FAB Etihad Guest Elite Account – A Blend of Finance and Travel

At its core, the FAB Etihad Guest Elite Account is more than just a bank account. It’s a financial gateway into the Etihad Guest ecosystem, rewarding you for maintaining balances and making transactions. For expats in Dubai and Abu Dhabi who travel frequently—whether for business or leisure—this account provides unmatched convenience and lifestyle perks.

TheDubaiWeb.com recommends this account for professionals, entrepreneurs, and travel enthusiasts who want a banking solution tailored to international lifestyles.

Frequently Asked Questions (FAQ)

1. What is the minimum balance for the FAB Etihad Guest Elite Account?

There’s no mandatory minimum balance to maintain the account. However, an average monthly balance of AED 10,000 is required to earn Guest Miles.

2. Is this a multi-currency account?

No. The FAB Etihad Guest Elite Account is AED-only. For multi-currency needs, FAB offers separate products.

3. What does “total relationship balance” mean?

It’s the combined value of your deposits, savings, current accounts, fixed deposits, and investments with FAB.

4. What are the debit card limits?

Daily limits include AED 75,000 for retail purchases and AED 30,000 for ATM withdrawals.

5. Do I need a salary transfer to open the account?

No, salary transfer is optional. You can fund your account through deposits or transfers.

6. What travel benefits are included?

- Free lounge access to 650+ airports.

- Travel accident insurance (up to USD 500,000).

- Concierge services and global medical support.

7. How do I get free Etihad lounge access?

Simply use your Etihad Guest Signature debit card, which comes with the account, to enjoy complimentary access.

8. What are the Etihad Guest membership levels?

Etihad Guest has Bronze, Silver, Gold, and Platinum tiers. Your FAB account helps you earn miles to upgrade your tier.

- Al Mahatta Park Sharjah Area Guide – Timings, Location, Facilities & Nearby Attractions UAE - February 22, 2026

- Lulu balance Check UAE – How to Check Lulu Salary Card Balance Online, SMS, ATM & App (2026 Guide) - February 21, 2026

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026