Opening a Bank Account in Dubai: The Complete 2025 Guide for Non-Residents & Expats

In a world where global finance is more connected than ever, Dubai stands out as a premier banking destination. Thanks to its tax-friendly policies, international connectivity, and top-tier financial institutions, many foreigners and non-residents are now exploring how to open a bank account in Dubai—whether for personal wealth management, real estate investment, or business operations.

If you’re asking: Can a non-resident open a bank account in the UAE? The answer is yes – but it comes with conditions. This in-depth guide unpacks every aspect of opening a bank account in Dubai, especially for those without a UAE residency visa.

Why Open a Bank Account in Dubai?

Dubai’s banking ecosystem is globally respected. Here’s what makes it unique:

- Zero personal income tax: The UAE does not levy taxes on salaries, investments, or inheritances.

- Strong banking infrastructure: Home to globally recognized banks like Emirates NBD, Mashreq, and ADCB.

- Multi-currency accounts: Most accounts support AED, USD, EUR, and GBP.

- Unrestricted international transfers: Full capital repatriation, no currency control.

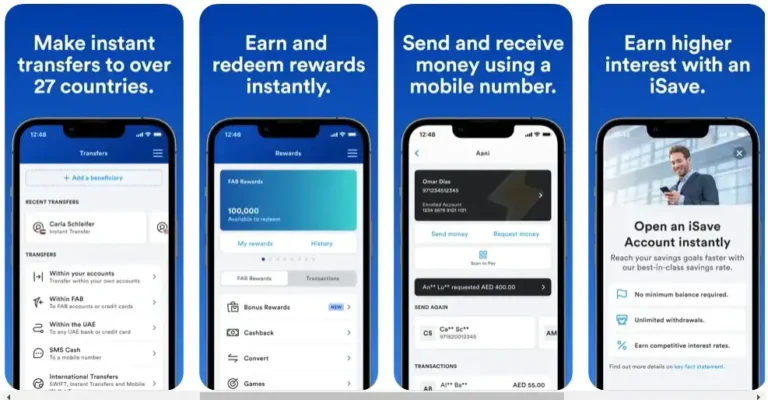

- World-class digital banking: Online platforms are robust, secure, and user-friendly.

Whether you’re an investor, freelancer, digital nomad, or global entrepreneur, having a Dubai bank account offers financial flexibility and access to a stable, well-regulated system.

Recommended: FAB ATM Near You

Can Non-Residents Open a Bank Account in Dubai?

Yes, non-residents can open a savings account in the UAE. However, opening a current account or accessing full financial services (like loans, checkbooks, or credit cards) requires a UAE residence visa and an Emirates ID.

Key Requirements for Non-Residents:

- Personal visit to the UAE – Remote opening isn’t allowed. A physical presence is required, even if for a single business day.

- Bank’s initial approval – Non-residents must be pre-approved based on compliance and risk assessments.

- Proof of income and address – Submit 6 months of recent bank statements and paid utility bills.

- Minimum balance – Many banks require a 100,000 AED minimum monthly balance.

- Account type – Only savings accounts are available for non-residents. Current accounts need a residency visa.

Benefits of a UAE Bank Account for Non-Residents

Despite the limitations, having a Dubai-based savings account still provides key advantages:

1. No Personal Income Tax

You won’t pay taxes on income deposited in your UAE account. However, your global tax obligations still apply. If you’re tax-resident in another country, you may need to declare your UAE bank accounts or pay taxes on international earnings.

2. No Reporting Requirements in the UAE

The UAE does not impose local reporting obligations for incoming funds on personal accounts, unlike the CRS (Common Reporting Standard) rules in the EU.

3. Multi-Currency Flexibility

Accounts are available in AED, USD, and sometimes EUR or GBP, allowing for easier international financial management.

4. Free Debit Card & Online Banking

You’ll receive an AED-based debit card usable globally, with daily ATM withdrawal limits around 15,000 AED. Online banking comes standard.

5. Unlimited Transfers & Repatriation

Non-resident accounts support international transfers without restrictions. There are no capital controls, but large transactions may require justification to comply with anti-money laundering (AML) laws.

Recommended: FAB Balance Check

Limitations of Non-Resident Bank Accounts in Dubai

While functional, non-resident accounts come with constraints:

- No online opening option – Must visit the UAE in person.

- No credit cards or checkbooks – Only residents are eligible.

- Limited loan and financing services – Non-residents cannot access mortgages or overdraft facilities.

- Longer KYC/compliance processes – Banks require additional documentation, especially for high-risk nationalities.

- Restricted banking options – Not all banks are open to non-resident clients.

Also note: Citizens of sanctioned countries like Iran, North Korea, and Israel are typically not eligible.

Which Banks in Dubai Offer Non-Resident Accounts?

Some of the most non-resident-friendly banks include:

- Mashreq Bank – Known for quick account setup and flexible options.

- Emirates NBD – Offers multi-currency savings accounts.

- Liv. Bank (by Emirates NBD) – Fully digital bank with modern features.

- Abu Dhabi Commercial Bank (ADCB) – Strong customer support and physical presence.

Each bank has its own eligibility criteria, so working with a consultant may help expedite the process.

Recommended: NBAD Bank Balance Check

How to Open a Bank Account in Dubai as a Non-Resident

Here’s what the process looks like:

Step 1: Pre-Consultation with a Banking Advisor

Engage a local business expert or advisory service who can:

- Evaluate your eligibility

- Recommend the right bank based on your nationality, goals, and risk profile

- Help gather necessary documents

Step 2: Travel to Dubai

Even one business day in the country is enough to:

- Meet with the bank

- Submit documents

- Complete biometric checks

Step 3: Submit Required Documents

- Valid passport (with visa if applicable)

- Recent bank statements (last 6 months)

- Proof of address (utility bill or tenancy contract)

- Source of income (salary certificate or tax returns)

Step 4: Await Compliance Review

Banks may take 1-3 weeks to process non-resident applications due to enhanced due diligence (EDD).

Step 5: Receive Account Details & Debit Card

Once approved, you’ll receive your account credentials, online banking access, and a debit card.

Costs & Maintenance for Non-Resident Accounts

| Item | Cost |

|---|---|

| Account opening fee | 0 AED |

| Minimum balance | 100,000 AED |

| Monthly maintenance fee | 0 AED |

| Debit card issuance | Free |

| Foreign currency deposits | ~1% transaction fee |

Should You Use an Advisory Firm?

For non-residents, professional assistance can significantly simplify the process. At TheDubaiWeb.com, we recommend working with licensed advisors who:

- Understand the compliance frameworks of UAE banks

- Can guide you through document preparation

- Have relationships with key institutions to reduce delays

If you’re unsure about eligibility, get a free consultation to:

- Check if you’re qualified to open a UAE account

- Compare banks suited to your profile

- Learn how to get a debit card as a non-resident

Recommended Guide:

- Ajman Bank

- Emirates Islamic Bank

- National Bank of Fujairah

- Noor Bank

- Dubai Islamic Bank

- Sharjah Islamic Bank

- Mashreq Bank

FAQ: Opening a Bank Account in Dubai

Q: What is required to open a Dubai bank account as a foreigner?

A: A valid passport, proof of income and address, six months of bank statements, and an in-person visit to a UAE bank.

Q: Do I need a salary certificate to open a bank account in Dubai?

A: Yes, some banks ask for a salary certificate or proof of income, especially if you are applying as a resident.

Q: What is the minimum salary to open an account in Dubai Islamic Bank?

A: Requirements vary, but many banks require a minimum salary of 3,000 to 5,000 AED per month for residents. For non-residents, a high minimum balance is usually more relevant.

Q: Can I open a bank account in Dubai without a salary?

A: Yes, particularly if you can maintain the required minimum balance (e.g., 100,000 AED) or provide proof of income from investments, pensions, or other sources.

Q: Can I open a UAE bank account online as a non-resident?

A: No. Physical presence is required for non-residents due to KYC and compliance protocols.

- FAB Bank Prepaid Card Inquiry – Complete Guide for Balance Check, Enquiry Methods & Card Management in the UAE - January 7, 2026

- FAB Salary Card Balance Check UAE – Online, SMS & ATM - January 6, 2026

- HSBC Bank Opening Hours in the UAE 2026 - January 3, 2026